Personal Gadget Insurance Market Expands with Surge in Smartphone & Wearable Adoption

"Global Executive Summary Personal Gadget Insurance Market: Size, Share, and Forecast

CAGR Value

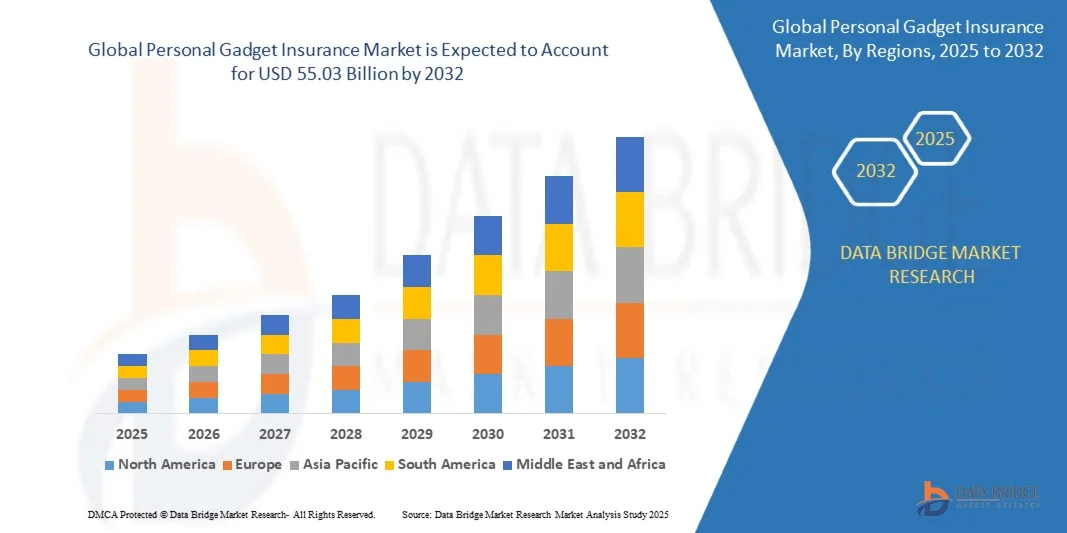

The global personal gadget insurance market size was valued at USD 25.30 billion in 2024 and is projected to reach USD 55.03 billion by 2032, with a CAGR of 10.20% during the forecast period of 2025 to 2032.

Keeping into consideration the customer requirement, this Personal Gadget Insurance Market research report has been constructed with the professional and comprehensive study. The report comprises explicit and up-to-date information about the consumer’s demands, their likings, and their variable preferences about particular products. Market research reports are acquiring huge importance in this speedily transforming market place; hence this Personal Gadget Insurance Market report has been endowed in a way that you anticipate. This market research report displays several parameters related to Personal Gadget Insurance Market industry which are systematically studied by the experts. This Personal Gadget Insurance Market report is most suitable for business requirements in many ways.

Personal Gadget Insurance Market report conducts study of market drivers, market restraints, opportunities and challenges underneath market overview which provides valuable insights to businesses for taking right moves. This market report is a source of information about Personal Gadget Insurance Market industry which puts forth current and upcoming technical and financial details of the industry. The market report is a window to the Personal Gadget Insurance Market industry which defines properly what market definition, classifications, applications, engagements and market trends are. Moreover, market restraints, brand positioning, and customer behaviour, is also studied with which achieving a success in the competitive marketplace is simplified.

Stay ahead with crucial trends and expert analysis in the latest Personal Gadget Insurance Market report.Download now:

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market

Personal Gadget Insurance Industry Overview

**Segments**

- Based on the type of gadget, the personal gadget insurance market can be segmented into smartphones, tablets, laptops, cameras, and others. Smartphones are expected to dominate the market due to their widespread usage and high vulnerability to damages.

- Geographically, the market can be segmented into North America, Europe, Asia-Pacific, and the rest of the world. North America is anticipated to lead the market, driven by the high adoption of advanced gadgets and the presence of key market players in the region.

- In terms of coverage type, the market can be segmented into accidental damage, theft, breakdown, and others. Accidental damage coverage is expected to hold a significant market share as it is a common risk associated with personal gadgets.

**Market Players**

- Allianz Global Assistance

- American International Group, Inc.

- Asurion

- Aviva

- AXA

- Assurant, Inc.

- Berkshire Hathaway Specialty Insurance

- Chubb Limited

- AmTrust Financial Services

- Liberty Mutual Insurance

The global personal gadget insurance market is witnessing significant growth due to the increasing popularity of high-end personal gadgets and the rising awareness regarding the benefits of insurance coverage. With the increasing instances of device damage, theft, and breakdowns, consumers are realizing the importance of protecting their valuable gadgets with insurance policies. The market is also being driven by the rapid technological advancements in gadgets, leading to higher replacement and repair costs in case of unforeseen incidents.

North America is expected to dominate the market due to the presence of technologically savvy consumers and a well-established insurance sector. The region is witnessing a surge in demand for personal gadget insurance as consumers seek comprehensive coverage for their expensive devices. Europe is also a key market owing to the high adoption rate of gadgets and the presence of prominent insurance providers.

The market players are focusing on expanding their product portfolios and enhancing their distribution networks to cater to a larger customer base. Partnerships and collaborations with gadget manufacturers and retailers are becoming increasingly common to offer bundled insurance packages to consumers at the point of sale. Additionally, the players are investing in technological advancements such as mobile apps and online platforms to streamline the insurance purchase and claims process for customers.

In conclusion, the global personal gadget insurance market is poised for steady growth driven by the increasing need for protection against device-related risks. As consumers continue to invest in expensive gadgets, the demand for insurance coverage is expected to rise, presenting lucrative opportunities for market players to innovate and capture market share.

The global personal gadget insurance market is witnessing a notable surge in growth driven by several key factors. One significant trend shaping the market is the increasing consumer inclination towards owning high-end personal gadgets such as smartphones, tablets, laptops, and cameras. With the rise in ownership of these valuable devices, there is a growing awareness among consumers regarding the risks associated with damages, theft, and breakdowns. This awareness has led to a higher demand for insurance coverage to protect these gadgets from unforeseen incidents, thereby driving the market growth.

Furthermore, the market is also benefiting from the constant technological advancements in gadgets, which have resulted in higher replacement and repair costs. As gadgets become more sophisticated and expensive, the need for insurance coverage becomes more apparent to consumers, leading to a positive growth trajectory for the personal gadget insurance market.

In terms of geographical segmentation, North America is anticipated to lead the market due to the presence of tech-savvy consumers and a well-established insurance sector. The region's high adoption rate of advanced gadgets and the willingness of consumers to invest in insurance coverage for their devices are significant factors contributing to market dominance. Europe also presents a lucrative market for personal gadget insurance, driven by the widespread adoption of gadgets and the presence of established insurance providers offering comprehensive coverage options.

Market players in the personal gadget insurance space are actively focusing on diversifying their product portfolios and expanding their distribution channels to reach a broader customer base. Collaborations with gadget manufacturers and retailers are becoming increasingly common, as bundled insurance packages offered at the point of sale represent an attractive proposition for consumers. Additionally, investments in technological innovations such as mobile apps and online platforms are aimed at enhancing the overall customer experience by simplifying the insurance purchase process and streamlining claims procedures.

In conclusion, the global personal gadget insurance market is poised for sustained growth as the need for insurance coverage for valuable devices continues to rise in tandem with the proliferation of high-end personal gadgets. Market players are poised to capitalize on this increasing demand by innovating their offerings and leveraging strategic partnerships to drive market expansion and capture a larger market share in the evolving landscape of personal gadget insurance.The global personal gadget insurance market presents a promising outlook as it continues to witness significant growth driven by various factors. One emerging trend that is shaping the market is the increasing focus on customization and flexibility in insurance policies. Consumers are seeking tailored coverage options that cater to their specific needs and preferences when it comes to protecting their personal gadgets. This trend is prompting insurance providers to offer more personalized solutions such as modular coverage plans, add-on options for specialized protection, and customizable deductibles to enhance consumer satisfaction and meet evolving demands in the market.

Moreover, there is a growing emphasis on the integration of digital technologies and data analytics in the personal gadget insurance sector. Insurance companies are leveraging advanced analytics tools and artificial intelligence to assess risks more accurately, personalize premiums based on individual usage patterns, and improve the overall customer experience through streamlined processes and quicker claims settlements. These technological advancements are not only enhancing operational efficiency for insurers but also empowering consumers with greater transparency, convenience, and control over their insurance coverage.

Another key development in the personal gadget insurance market is the shift towards environmentally sustainable practices and eco-friendly offerings. As sustainability becomes a priority for consumers worldwide, insurance providers are increasingly incorporating green initiatives into their product offerings, such as eco-friendly repair services, recyclable packaging for replacement devices, and carbon offset programs for device replacements. By aligning with sustainable practices, insurance companies can not only attract environmentally conscious consumers but also contribute to a more eco-responsible industry ecosystem.

Furthermore, the advent of new regulatory frameworks and compliance standards is influencing the landscape of the personal gadget insurance market. Insurers are facing evolving regulatory requirements related to data protection, cybersecurity, consumer privacy, and transparency in insurance product disclosures. To ensure compliance and build trust with consumers, insurance providers are proactively adapting their policies, procedures, and systems to adhere to regulatory changes and uphold the highest standards of ethical business practices.

Overall, the personal gadget insurance market is experiencing a transformational period marked by evolving consumer preferences, technological advancements, sustainability initiatives, and regulatory dynamics. As insurance companies navigate these shifts and embrace innovation, they are well-positioned to capitalize on emerging opportunities, differentiate their offerings, and drive sustainable growth in the competitive landscape of personal gadget insurance.

Access detailed insights into the company’s market position

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market/companies

Alternative Research Questions for Global Personal Gadget Insurance Market Analysis

- What is the current valuation of the global Personal Gadget Insurance Market?

- What CAGR is projected for the Personal Gadget Insurance Market over the forecast period?

- What are the key segments analyzed in the Personal Gadget Insurance Market report?

- Which companies dominate the Personal Gadget Insurance Market landscape?

- What geographic data is covered in the Personal Gadget Insurance Market analysis?

- Who are the leading firms operating in the Personal Gadget Insurance Market?

Browse More Reports:

Global Corporate Web Security Market

Global Long Steel Market

Asia-Pacific Glioblastoma Multiforme Treatment Market

Global Winter Sports Equipment Market

Asia-Pacific Hot Fill Packaging Market

Middle East And Africa Industrial Personal Computer (PC) Market

Middle East and Africa Bee Products Market

Global Dental Wax Market

China Automotive Testing, Inspection and Certification (TIC) Market

Global Agro Textile Market

Global Pediatric Medical Device Market

Global Pneumococcal Vaccine Market

Global Portable Gas Chromatograph Market

Asia-Pacific Tomatoes Market

North America Commodity Plastic Market

Global Halloumi Cheese Market

Global Grape Seed Extract Market

Europe FDM Composite Large-Size Tooling Market

Global Security Bags Market

Global Hemp Clothing Market

Global Laminated Glass Market

Middle East and Africa Glioblastoma Multiforme Treatment Market

Asia-Pacific Cognitive Assessment and Training Market

Global Post Acute Myocardial Infarction Market

Middle East and Africa Radiology Services Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"